Knowledge management in the banking industry: The Banking Knowledge Management Model (BKMM)

Whilst the principal objectives of the central bank remain unchanged, the new knowledge management strategies refocus the Bank’s policies and practices in managing knowledge as a key corporate asset, and in leveraging and exploiting knowledge to better achieve these objectives.

Governor of Bank Negara Malaysia, official launch of

‘Towards a Knowledge-Based Organisation’

program, October 20001

Knowledge management (KM) plays a critical role in all industries. Last summer vacation, I completed an internship at a commercial bank, therefore, I began to look back on this internship experience and think about the application of KM in the banking industry.

Why does the banking industry need knowledge management?

Complex structure of banks

The banking industry is different from other industries in that it has a complex organizational structure, which is often divided into head offices, regional branches, and city branches (even specifically to a certain street). The banking industry has the characteristics of wide knowledge distribution, high personnel participation, multiple levels, and a wide geographical and professional span. Therefore, the construction of a bank KM system must not only satisfy the horizontal KM within a single branch but also pay attention to hierarchical vertical integration in the entire banking organization.

Information overload

Knowledge is divided into explicit and tacit knowledge. For the banking industry, explicit knowledge is prone to information overload. There are a large number of static explicit knowledge collection and communication needs such as customer information, work plans, statistical tables, etc. However, most contemporary banking knowledge repositories are outdated. Internal staff still heavily rely on scattered documents and information from various isolated sources. The absence of a centralized web or cloud-based data repository means that the accuracy and currency of the information they access and share with customers cannot be guaranteed.

Services quality

As a service industry, the banking industry has a top priority in improving service quality and maintaining good customer relationships. This link mainly involves the enterprise’s tacit KM. Compared with explicit knowledge, enterprises are more likely to neglect the management of dynamic tacit knowledge, such as work experience and employees’ unique work skills.

Knowledge management best practices in banking

World Bank

World Bank has proposed the idea of a knowledge bank2. To collect and share knowledge, the World Bank has defined 80 areas of expertise and established global, informal communities of practice, each controlled through a help desk with the help of full-time knowledge managers and operational staff. An electronic bulletin board has been set up to collect best practices and lessons learned from relevant projects. In order to create an internal culture of knowledge sharing, the World Bank has established mechanisms such as knowledge-sharing awards in the talent evaluation system to enhance the initiative of all employees in improving knowledge sharing.

Wachovia Bank

Wachovia Bank has formed a unique KM and knowledge sharing model, divided into three stages3. The first stage allows call center employees to access department knowledge bases and seek back-end knowledge support, thereby reducing customer problem processing time. The second stage is the establishment of various departments within the industry. A knowledge resource team is responsible for combing, confirming, and retrieving the information entering the knowledge base to ensure the accuracy of the knowledge base. The third stage is to build a KM platform covering the entire bank and promote the realization of paper documents electronification and structured electronic documents covering the entire bank, achieving a double cycle of personnel and knowledge.

Central Bank of Malaysia

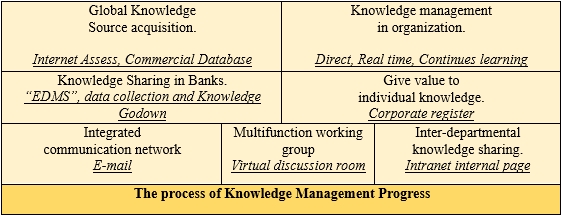

The Knowledge Management Progress of the Central Bank of Malaysia4 focuses more on IT tools in managing knowledge.

The strategy of embedding KM practices into work processes began in 2000. A key milestone was the successful completion of the Bank’s corporate taxonomy project. The taxonomy is the Bank’s information classification framework that has been deployed as a foundation to develop a knowledge repository management system referred to as the Bank’s Knowledge Hub. Supported by search engines and information security policies, the Knowledge Hub serves to enhance knowledge visibility and accessibility, thus facilitating further the process of knowledge acquisition, reuse, sharing, and creation.

Banking Knowledge Management Model

Based on their review of KM in the banking sector, Ali and Ahmad propose the Banking Knowledge Management Model (BKMM)5 as a new approach based on the concept of KM postulated by Wiig and Prusak6.

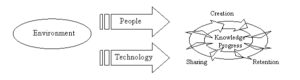

A constantly changing environment may compel organizations to initiate KM practice. The working environment demands that organizations respond rapidly, capitalizing on lessons learned. However, this approach has many limitations as the decisions made based on past experience may not be the most appropriate one. Consequently, there is a need for a sophisticated level of “know-how”, “know-what”, “know-who”, “know-where” and “know-why”.

People and technology are two factors that affect the efficient implementation of KM. It is challenging to get employees to embrace a KM-oriented culture. According to Duffy7, sharing knowledge especially proprietary or individual knowledge could result in power redistribution and cultural resistance. Along with mergers, acquisitions, and alliances, banks are expanding and their business types are becoming more and more diversified. The knowledge that banks possess and the knowledge they need to handle their business is also more fragmented. Information technology is only effective if used properly in data management.

Ali and Ahmad theorized that people and technology are the elements that contribute to knowledge progress. Knowledge progress can be divided into three components namely knowledge creation, knowledge retention, and knowledge sharing. Knowledge creation is the progress in which knowledge is captured and defined. Through this codification process, tacit knowledge is transformed into explicit knowledge. The main purpose of knowledge retention is to allow knowledge reuse. At the same time, it is equally important to protect knowledge and how to plan security measures to ensure the integrity of knowledge. Erroneous knowledge is just as damaging as inaccessible knowledge if not more. Finally, there is knowledge sharing. Explicit knowledge can be shared more easily, with little risk of errors being made in the process. Tacit knowledge is difficult to express and is a challenging part of knowledge sharing. Regardless, knowledge sharing8 should be as direct and as minimally intermediary as possible.

Facing future challenges

In the current environment, KM in the banking sector isn’t a nice to have – it’s a necessity. The BKMM model provides a framework for future research in KM integration in the banking sector. However, with accelerating development, commercial banks are facing increasing risks, including credit risk, liquidity risk, financial innovation and derivative business risk, and internal management risk. How to apply KM to control risks is a new dimension.

Around 2015, the banking industry began to come into contact with the concept of knowledge graphs playing great value in risk control. For example, for the prediction of potential risky customers, by establishing a knowledge graph of customers, companies, and industries, and connecting data between industries and companies, banks can discover potential risky customers in a timely manner and reduce credit risks.

Facing unknown developments in the future, banks should increase the development and implementation of KM systems and optimize the powerful functions of information capturing, storing, and retrieving in a centralized hub.

Article source: Adapted from Knowledge Management in Banking Industry, prepared as part of the requirements for completion of course KM6304 Knowledge Management Strategies and Policies in the Nanyang Technological University Singapore Master of Science in Knowledge Management (KM).

Header image source: Created by Bruce Boyes with Perchance AI Photo Generator.

References:

- Ali, H. M., & Ahmad, N. H. (2006). Knowledge management in Malaysian banks: a new paradigm. Journal of Knowledge Management Practice, 7(3), 1-13. ↩

- The World Bank. (2018, December 6). Knowledge Management at the World Bank. ↩

- Melymuka, K. (2003, February 26). Premier 100: Managing knowledge at Wachovia. Computerworld. ↩

- Ali, H. M., & Ahmad, N. H. (2006). Knowledge management in Malaysian banks: a new paradigm. Journal of Knowledge Management Practice, 7(3), 1-13. ↩

- Ali, H. M., & Ahmad, N. H. (2006). Knowledge management in Malaysian banks: a new paradigm. Journal of Knowledge Management Practice, 7(3), 1-13. ↩

- Edwards, J., & Lönnqvist, A. (2023). The future of knowledge management: an agenda for research and practice. Knowledge Management Research & Practice, 21(5), 909-916. ↩

- Duffy, J. (1999). Harvesting Experience: Reaping the Benefits of Knowledge, Prairie Village, KS: ARMA International. ↩

- Buckman, R. H. (1998). Knowledge sharing at Buckman Labs. Journal of business strategy, 19(1), 10-15. ↩