Decentralization helps firms weather turbulent times

Originally posted on The Horizons Tracker.

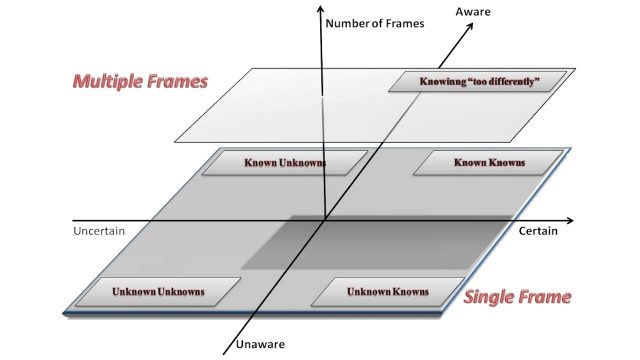

Now, more than ever, the volatility captured by the somewhat over-used VUCA acronym is perhaps becoming reality, and with it significant changes in the approach of organizations to this volatility. A new paper1 highlights the importance of a decentralized organizational structure during such periods of turbulence.

The authors highlight how in times of uncertainty, the ability to make swift decisions is hugely important. What’s more, local managers usually have access to more accurate and timely information with which to make those decisions. As such, empowering those local decision-makers often leads to the best responses.

Crisis management

The researchers considered a couple of large microdata sets from a number of OECD countries and from the administrative data at various manufacturing plants across the US.

The data allowed the researchers to understand how much plant managers could invest without requiring prior authorization. The managers also revealed how autonomous their decision making was in terms of new products, sales and marketing decisions, and hiring permanent employees. The data covered the period on either side of the 2008 financial crisis, so allowed comparisons to be made before and after.

The data revealed that in the sectors where the crisis struck hardest, those who operated a more decentralized approach outperformed their more centralized rivals in terms of productivity, sales, and ultimately, survival.

Buffering the impact

This isn’t to say that decentralized firms managed to grow during the crisis, but more that the negative impact was lessened. The data shows that sales at decentralized firms fell by 8.2% compared to 11.8% in centralized firms.

This divergence in performance was largely confined to the specific crisis period, with both centralized and decentralized firms converging again within around five years.

During crises, however, the difference is stark, with the sales of centralized firms shrinking three times as much, with this often driven by a stark fall in productivity. When the researchers analyzed the situation in more depth, it emerged that a key benefit of decentralization is the ability to decide outputs, such as new products and sales, which was more important than being able to control inputs, such as capital investment and labor.

Managing during COVID-19

So does this have any lessons for managers during the COVID-19 pandemic, or is it too late to change firms to such an extent? The researchers believe even at this relatively late stage it’s not too late to change. Indeed, they argue that such crises often provide a fantastic opportunity to reorganize.

The researchers argue that decentralization tends to become more attractive when the workforce is more highly educated, so they believe that governments and policymakers could not only bolster state education, but also give further support for work-based training to improve the skills of the workforce.

With the latest technologies empowering flatter organizational structures, the kind of decentralized forms that provide greater resilience are increasingly common, which is generally positive, even aside from the resilience they provide in crises.

Article source: Decentralization Helps Firms Weather Turbulent Times.

Header image source: Wikimedia Commons, CC BY-SA 3.0.

Reference:

- Aghion, P., Bloom, N., Lucking, B., Sadun, R., & Van Reenen, J. (2021). Turbulence, Firm Decentralization, and Growth in Bad Times. American Economic Journal: Applied Economics, 13(1), 133-69. ↩